Tax Rebate For Solar 2025

Tax Rebate For Solar 2025. (the law that provides for this credit supersedes an. The credit reduces in 2033 and 2034, and is set to.

How to make the most of energy efficiency tax credits in 2025. Instructions for form 5695 (2022) page last reviewed or updated:

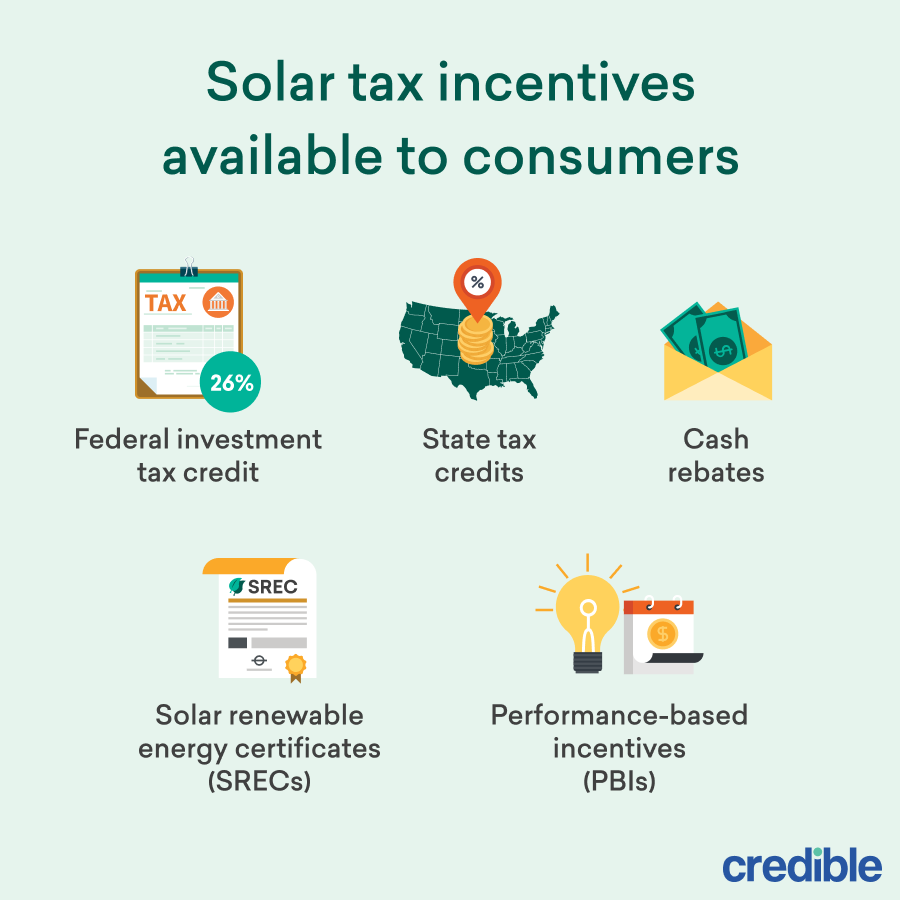

By Switching To Solar In 2023, Homeowners In New York Can Take Advantage Of Ongoing Federal, State And Local Incentives.

If you invest in renewable energy.

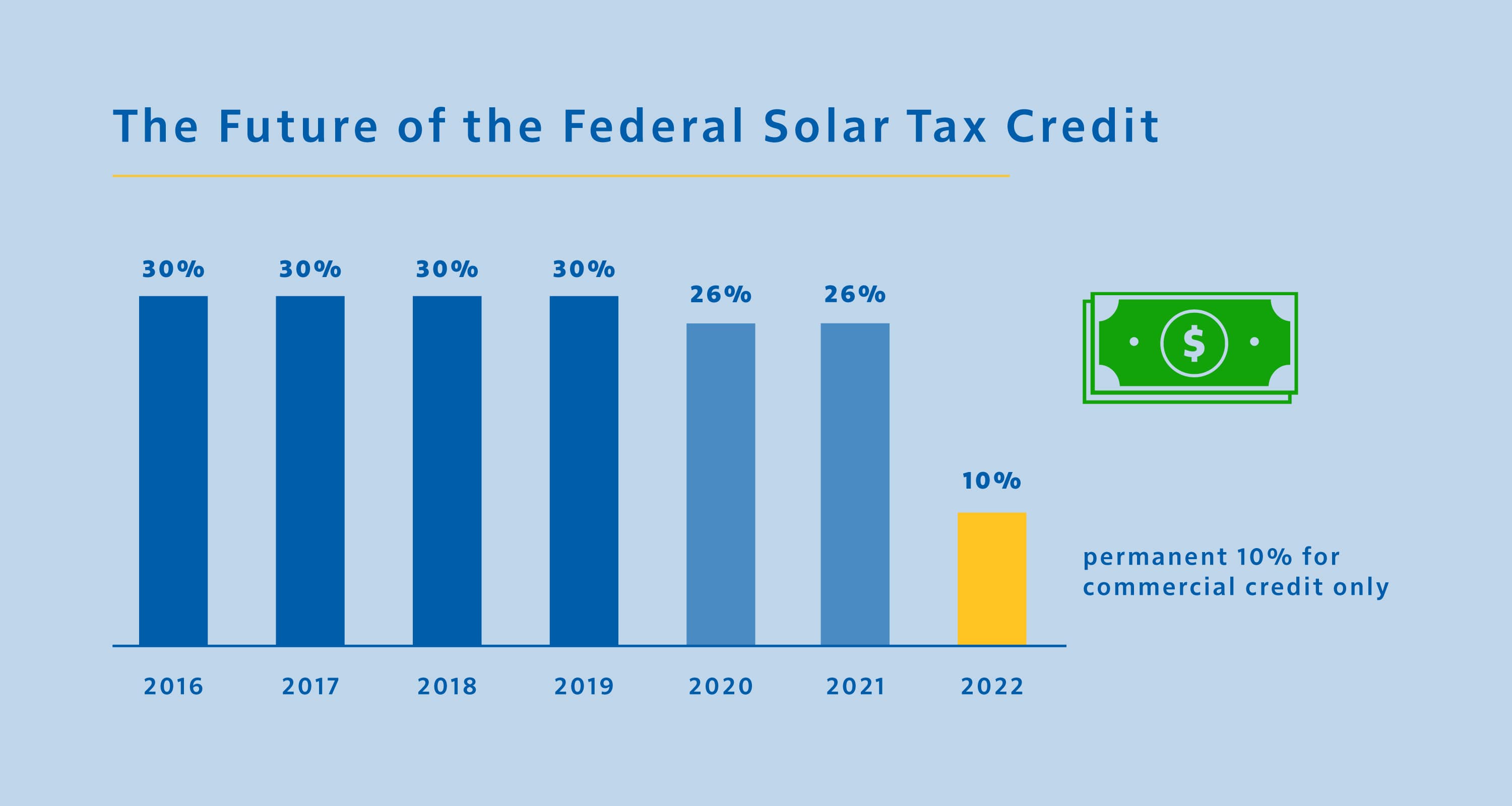

The Inflation Reduction Act Renamed And Extended.

The average arizona solar shopper will save $3,329 from the federal tax credit alone.

From Solar Panels To Evs And Insulation, There's A Lot Of Money On The Table This Tax Season.

Images References :

Source: www.ecowatch.com

Source: www.ecowatch.com

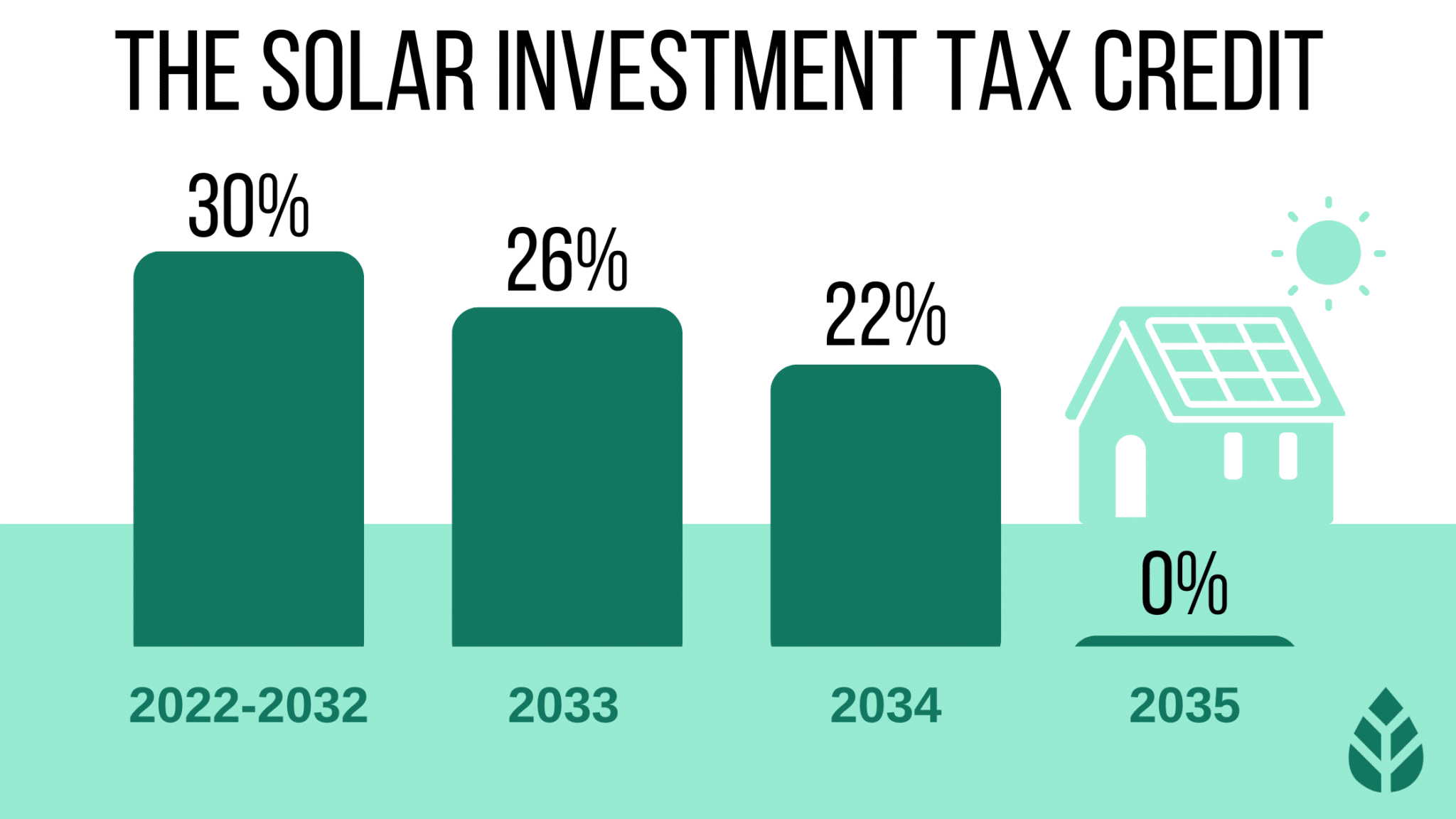

Texas Solar Incentives (Tax Credits, Rebates & More in 2023), It drops to 26 percent in 2033, then 22 percent in 2034, and disappears in 2035, unless congress continues it. (the law that provides for this credit supersedes an.

Source: simpliphipower.com

Source: simpliphipower.com

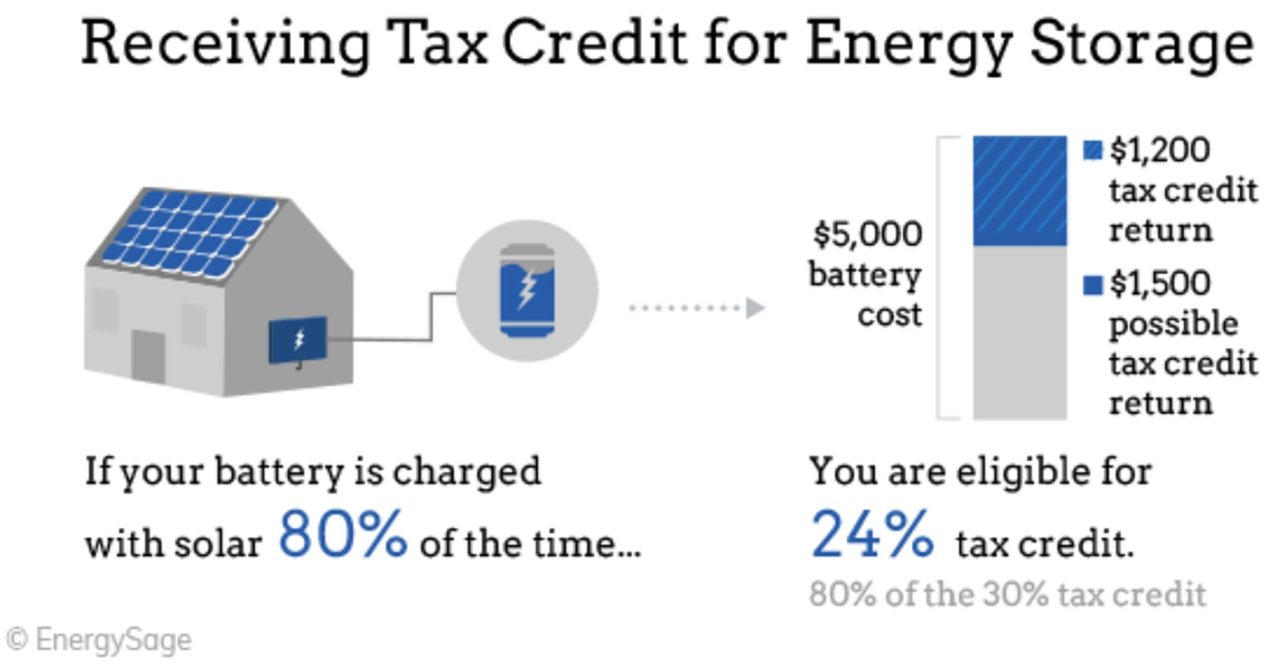

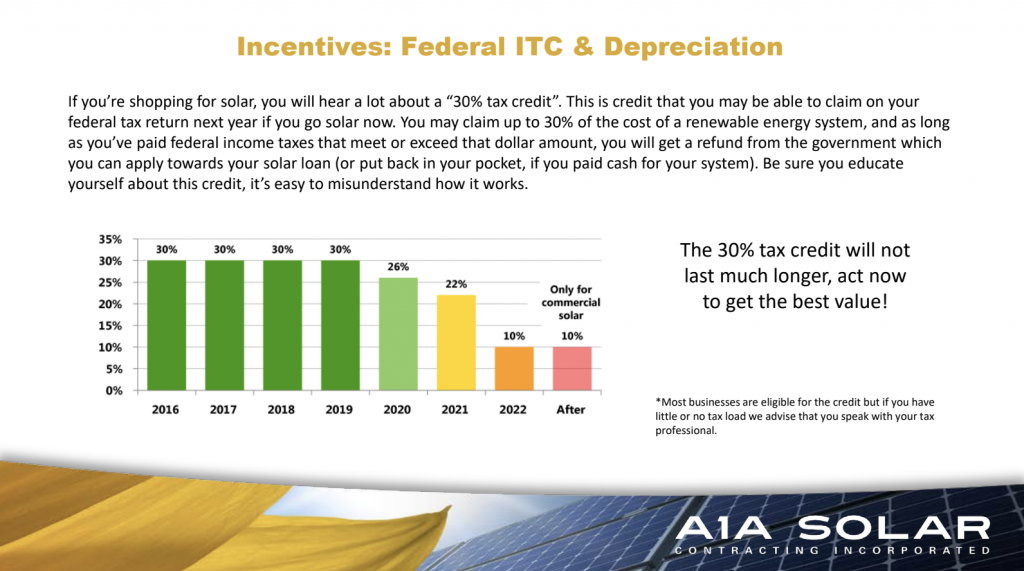

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, Instructions for form 5695 (2022) page last reviewed or updated: Depending on the installation year, you can claim a federal tax credit.

Source: nikizsombor.blogspot.com

Source: nikizsombor.blogspot.com

Solar tax credit calculator NikiZsombor, Energy efficiency tax credits for 2025 update: 2025 guide to solar incentives by state updated:

Source: sunlightsolar.com

Source: sunlightsolar.com

Federal Tax Credits Sunlight Solar Energy CO, OR, MA, CT, Can you lease solar panels in colorado? To get the most from the federal solar tax credit, the best time to go solar is any time before december 31, 2032.

Source: www.kcgreenenergy.com

Source: www.kcgreenenergy.com

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy, Learn how the federal solar tax credit works, how to qualify, what’s changed from. Arizona solar rebates and incentives:

Source: a1asolar.com

Source: a1asolar.com

Get a 30 federal tax credit for your solar panel system while you can, The federal solar tax credit will not last forever. The credit reduces in 2033 and 2034, and is set to.

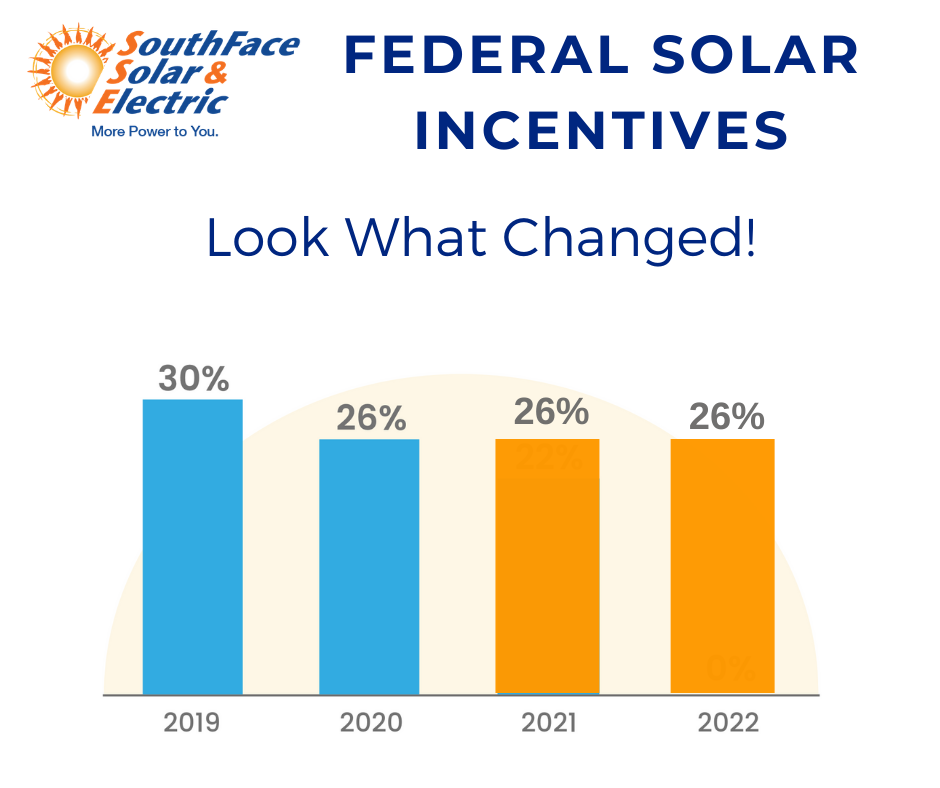

Source: southfacesolar.com

Source: southfacesolar.com

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ, If the system was installed in 2023, you can file for the residential clean energy credit on your 2023 tax return filed in 2025. For the 2033 tax year, it drops to a 26% credit, and for.

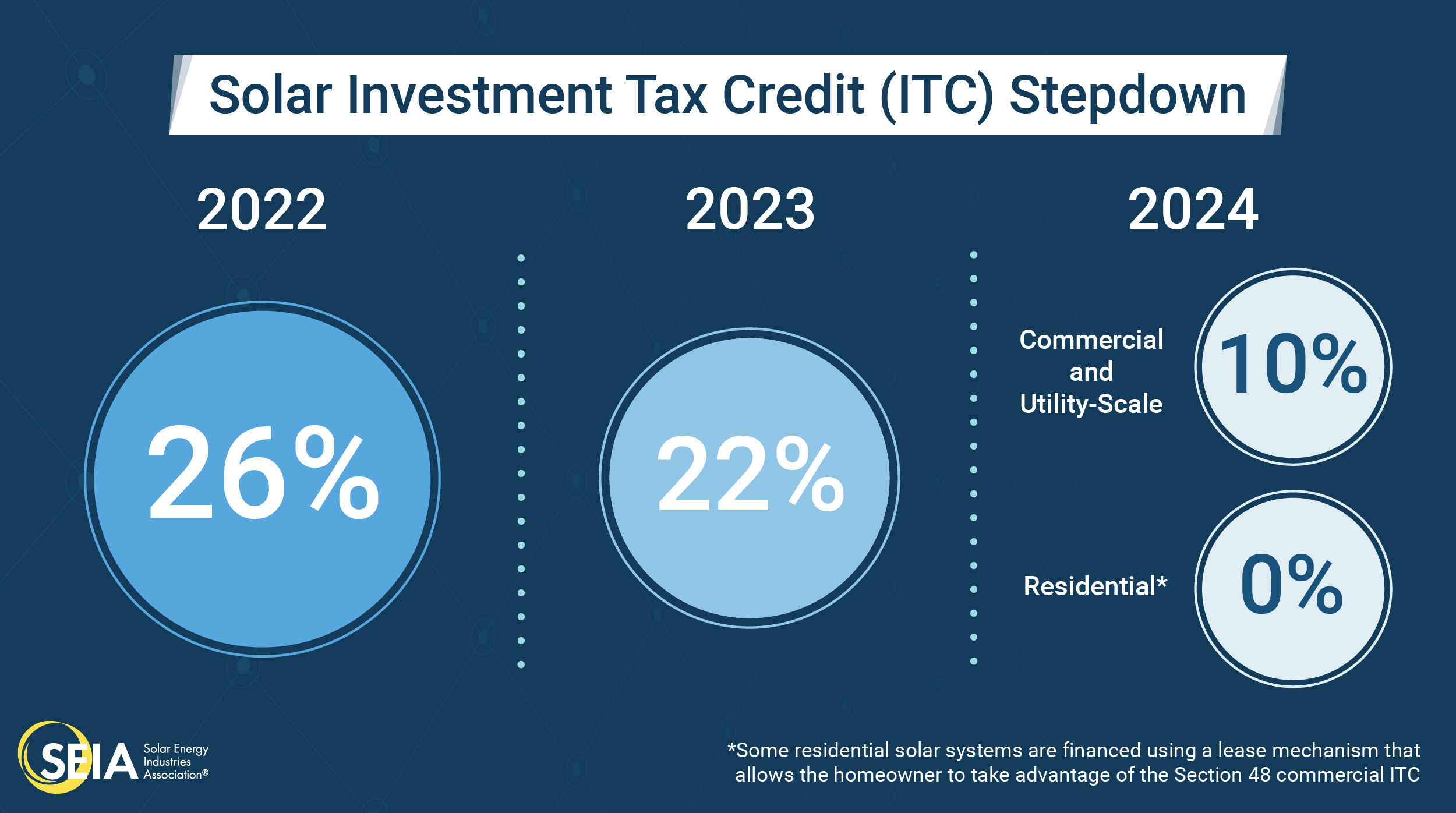

Source: seia.org

Source: seia.org

Solar Investment Tax Credit (ITC) SEIA, To get the most from the federal solar tax credit, the best time to go solar is any time before december 31, 2032. Learn how the federal solar tax credit works, how to qualify, what’s changed from.

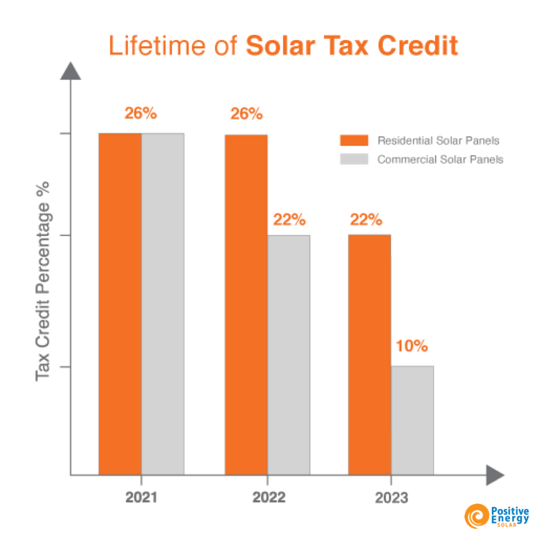

Source: www.positiveenergysolar.com

Source: www.positiveenergysolar.com

Federal Solar Incentives Renewed Through 2023, The inflation reduction act renamed and extended. The federal solar tax credit will not last forever.

Source: www.pugetsoundsolar.com

Source: www.pugetsoundsolar.com

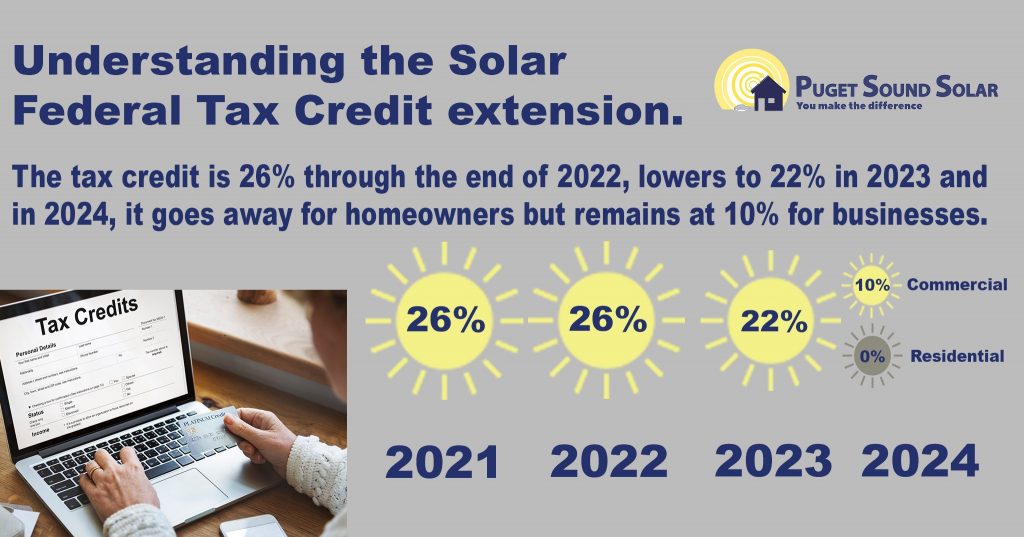

Understanding the Federal Solar Tax Credit Changes In 2021 Puget, The tax credits listed below became available on january 1, 2023 and can be claimed when you file your income. Instructions for form 5695 (2022) page last reviewed or updated:

About Form 5695, Residential Energy Credits.

How do you claim the solar tax.

In 2033, The Tax Credit You Can Claim Will Decline To 26% Of The Cost And, In 2034, To 22%.

The inflation reduction act renamed and extended.